Book Brief: Playing to Win

Bottom line, Playing to Win is likely the best book on strategy that I have yet read. It teaches concepts in an easy to understand way, provides frameworks that are easy to use in real world situations, and provides lots of examples to show how the frameworks work in a real company. I strongly recommend Playing to Win to anyone involved in strategy development and strategic decision making.

At the time Playing to Win was published, Roger Martin was Dean of the University of Toronto’s Rotman School of Management and A.G. Lafley was the former Chairman and CEO of Proctor & Gamble. The book’s title stems from the authors’ contention that companies must “play to win” or else they are wasting everyone’s time and investors’ money. Too many companies “play to play” which can appear to work for a time, but in the long run simply destroys value.

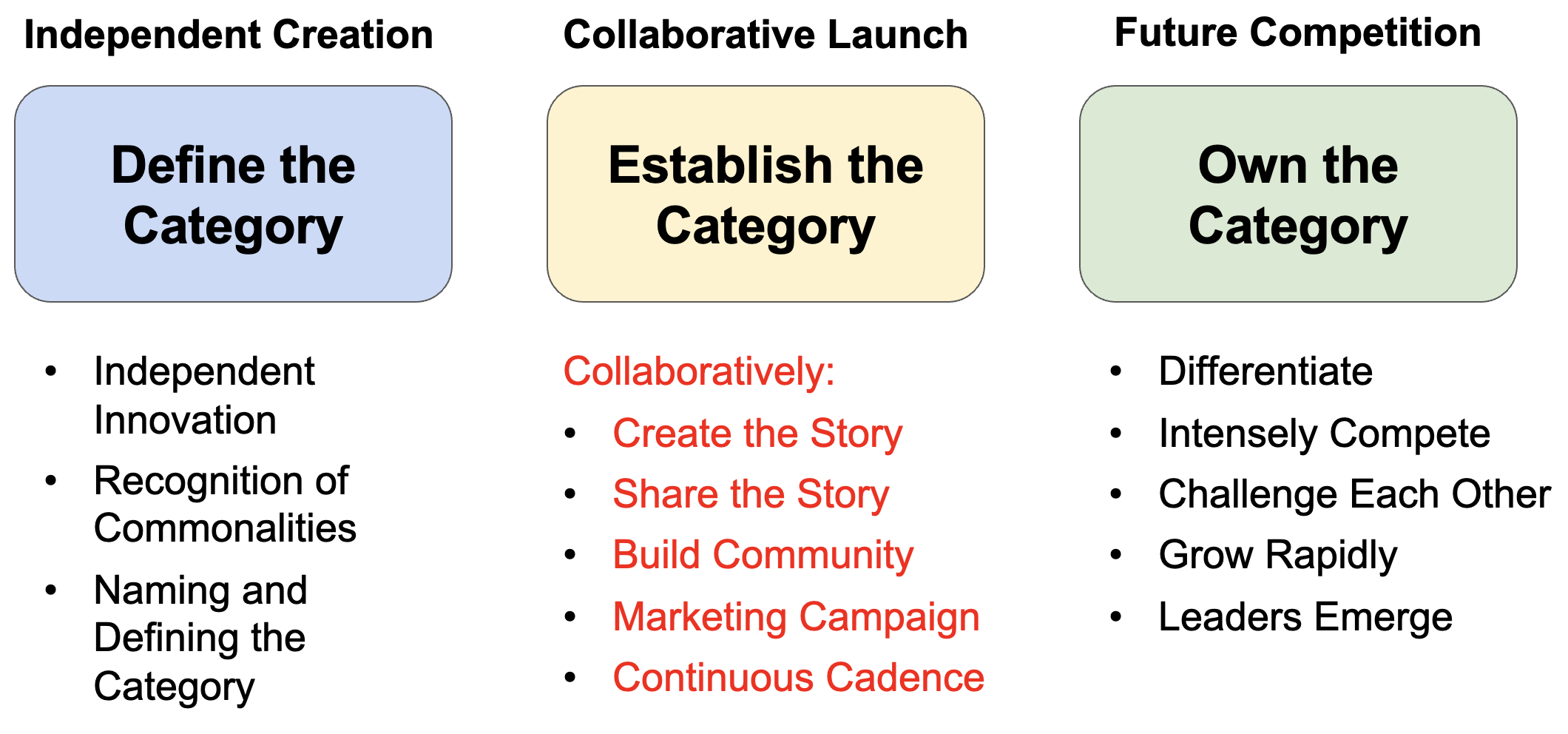

Playing to Win is mostly structured around the Strategy Choice Cascade. Proctor & Gamble examples are used throughout the book to demonstrate how the framework works in real life. The Strategy Choice Cascade is a series of five questions that define a company’s strategy:

- What is our winning aspiration?

- Where will we play?

- How will we win?

- What capabilities must be in place?

- What management systems are required?

Chapters 2 through 6 each deal with one of the questions in the cascade. The chapters often include tutorials in basic concepts of competitive strategy such as market segmentation, customer needs research, generic strategies, differentiation, etc. Each chapter includes detailed step-by-step case studies from P&G, a list of “dos and don’ts”, and often a story from either Martin or Lafley (or both) to share their personal experiences (sometimes painful) that helped them learn the key concepts covered in the chapter. There’s a lot of detail in these chapters beyond what the simple questions in the cascade might imply. Anyone involved in the kinds of hard strategic questions any business (especially a large one) faces will be able to relate to and learn from the many stories told and lessons taught.

Chapter 7 is titled “Think Through Strategy.” At the beginning of the chapter the authors point out that the cascade is helpful, but in the real world leaders will ask: “But how and where do you start? And how do you generate and choose between possibilities at each stage?” They offer another framework as a starting point. The final full chapter in the book introduces yet another framework to help with strategy development. The book closes with a short Conclusion titled “The Endless Pursuit of Winning” which ties the three main frameworks from the book into what the authors call a “playbook” for strategic management in a dynamic competitive world.

Book Brief: Playing to Win Read More »