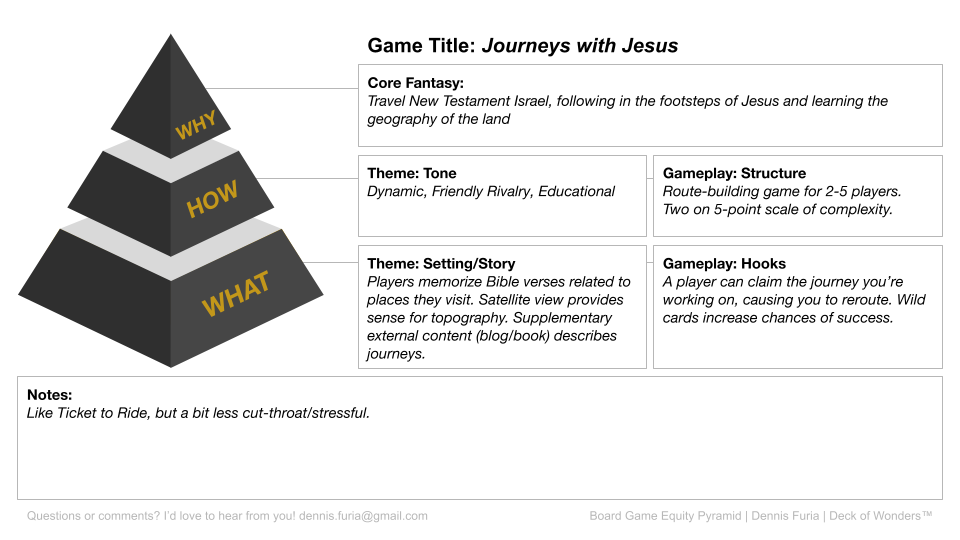

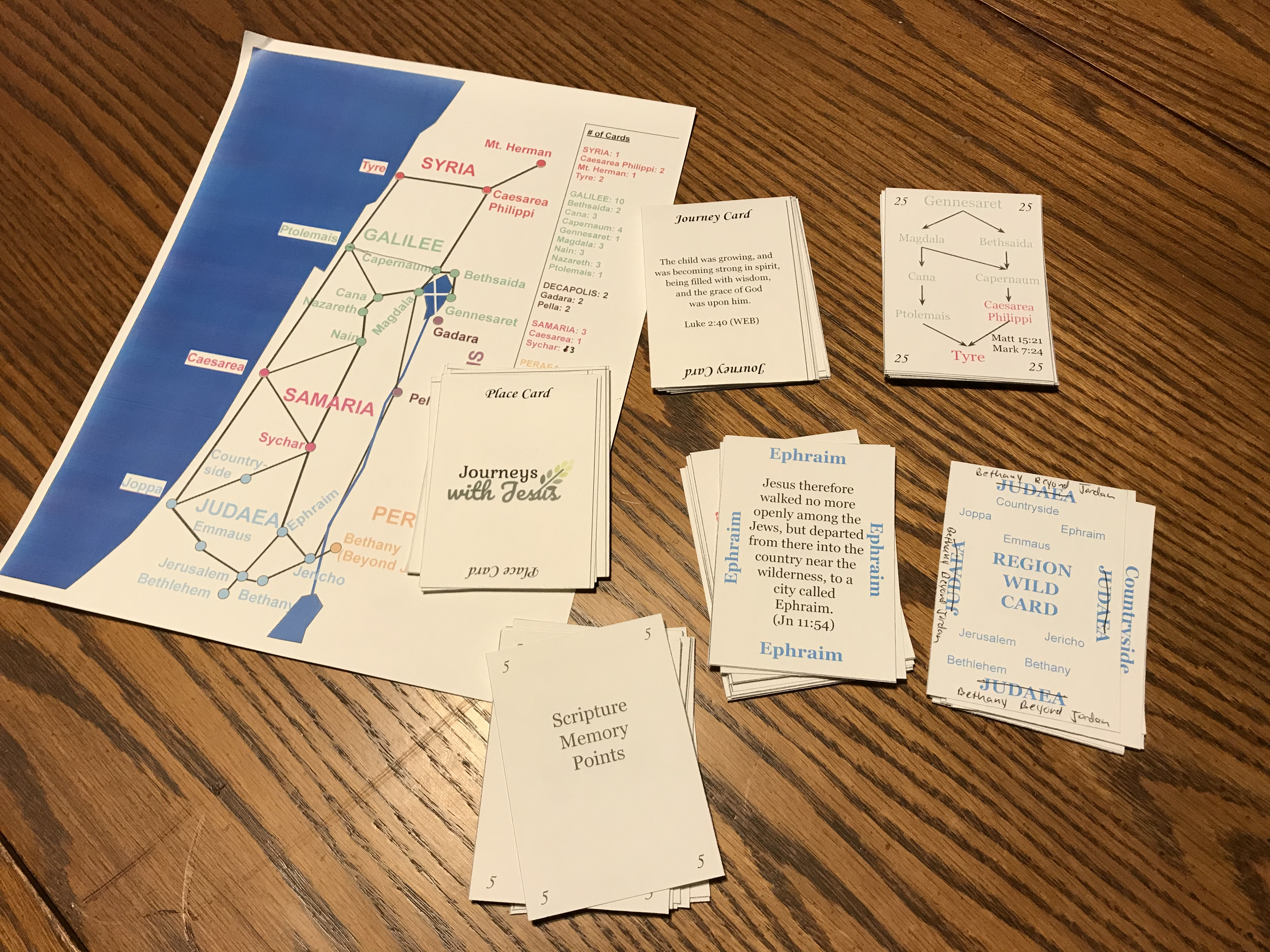

One of the key elements of the Lean Startup movement is quickly getting a “minimal viable product” (or MVP) into the hands of customers and learning whether or not your hypotheses about customers, problems, and your value proposition are correct. The MVP is really just the first in a number of iterations as you learn and adjust on the road to a successful market launch.

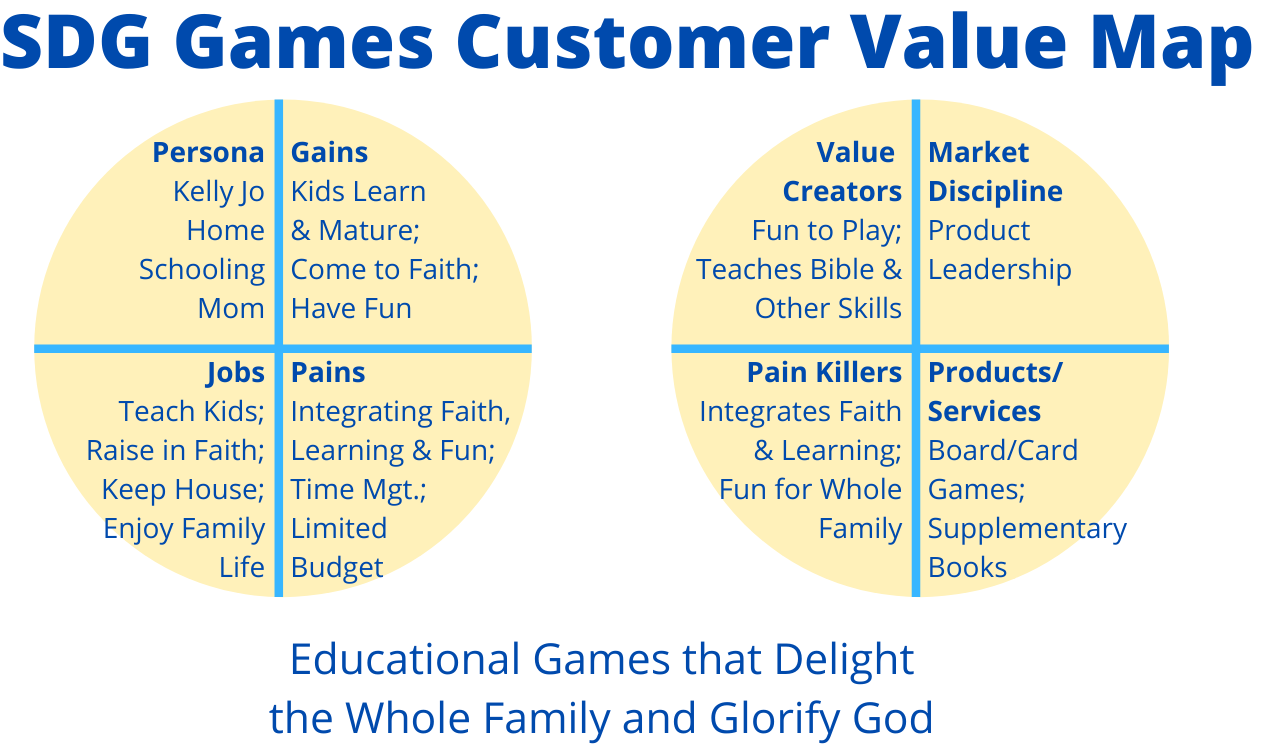

The most important hypotheses for a startup business are those dealing with the customer and the value proposition. Do you understand the customers and their needs, and does your product or service (and the way you are delivering it) meet those needs in a compelling way? While the customer discovery process can give you some level of confidence, you won’t really know until you put a product in the hands of a customer.

The minimal viable product is the fastest, cheapest form of your product that clearly communicates the core of your value proposition. This isn’t the product that you’ve dreamed of. It’s not beautiful. It doesn’t have all the features that you’ve imagined. In fact, LinkedIn founder Reid Hoffman famously said “If you are not embarrassed by the first version of your product, you launched too late.”

Read the full article linked here to learn more about MVPs, Validated Learning, and SDG Games’ MVP.