Earlier this week I started a new series on how the Connected Intelligence Revolution is redefining every product and every industry. Today, I want to look at garage door openers, to explain how challenging connected intelligence is for existing market leaders.

Garage door openers aren’t very susceptible to displacement by software. The factors that make an opener competitive — power, speed, quietness, reliability — have been developed by a small number of market leaders over several decades. A software engineer can’t simply write a few (thousand) lines of code and recreate those capabilities. That should be good news for the incumbents, but instead what we’ve seen is the evidence of how hard it is for existing players to adapt to new realities.

In his book, The Innovator’s Dilemma, Clayton Christensen described how companies and their ecosystem partners value the things that have always defined success in their industry (e.g. powerful motors and quiet screw drives and reliability). They don’t value things that have never defined success in their industry (e.g. software development and wireless security and agility and integration). They don’t have the architecture or the mindset to be leaders in those capabilities, and they struggle to assign resources and make the investments necessary to establish leadership in those disciplines.

While software-driven startups haven’t had success in building garage door openers, a few are having success with retrofit controllers. These devices are wirelessly connected and app controlled and simply appear to your existing garage door opener like another remote control. Several of these startups have taken the first steps from merely wirelessly connecting the garage door opener to actually bringing it into the Connected Intelligence Revolution.

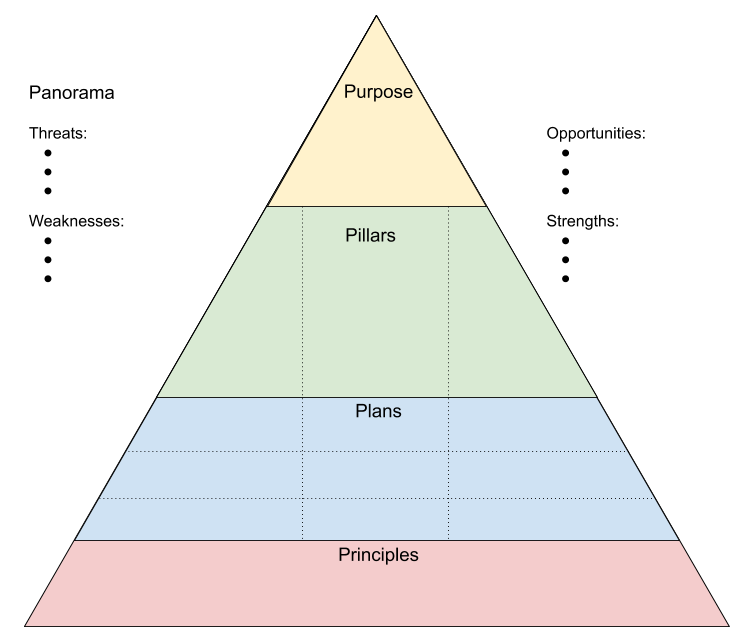

So incumbents need to consider whether and where they play in the Connected Intelligence Revolution. Do they need to overcome the inertia of their value network and truly lead in this new revolution, or do they focus on their traditional core strengths and look for partners and complementary ecosystem players to provide the connected intelligence (and be content merely being a commodity component of the total solution)?

That may sound like a simple question, but the implications are significant for value capture and the nature of the customer relationship. It should be approached with strategic rigor, discretion, and humility.

Read the full story here.