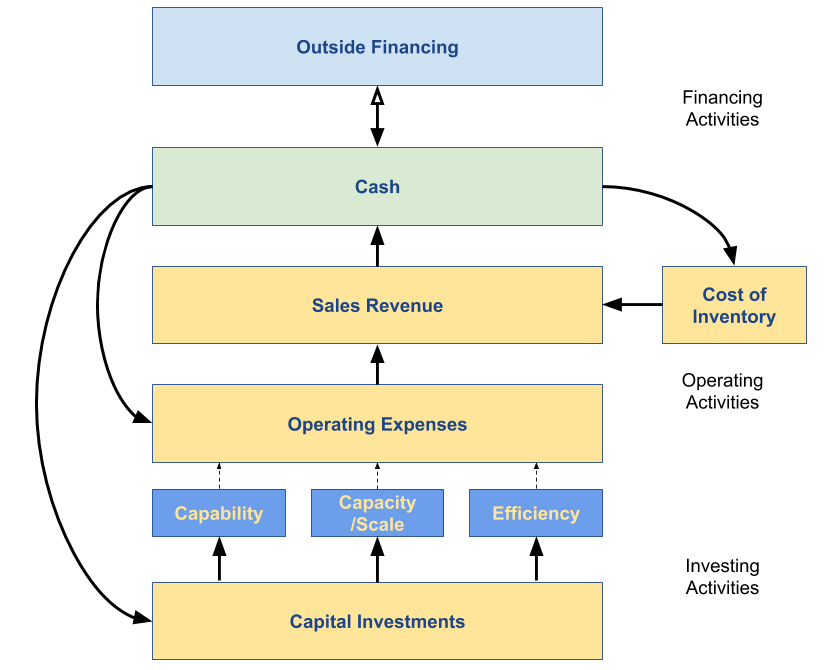

Throughout the week we’ve been looking at different aspects of the question “how do you make money?”. We’ve looked at revenue models, business models, and operating models, and along the way I’ve dropped hints about the linkages between those activities and cash flow, but today I want to focus specifically on how cash flows through a business.In today’s article I introduce a “cash cycle” – like the water cycle in nature, but showing how cash flows through a business. We then look at how elements from that cash cycle show up in a company’s income and cash flow statements and how we can determine whether or not the business has healthy cash flow.

Here are some important questions I try to answer from a company’s income statements:

- Are sales increasing?

- What is the gross margin? Have they set their prices high enough to support the business?

- What is the trend on EBITDA margins? Are they keeping operating expenses in line with revenues?

- Are they profitable (Net Income)?

The important questions I try to answer by looking at cash flow statements include:

- Is the business generating or consuming cash?

- Is cash flow improving or getting worse?

- Is the cash flow from Operating Activities positive or negative?

- If operations are consuming cash (negative cash flow from Operating Activities), what is the monthly burn rate, and given how much cash the business has on hand (from their balance sheet), what is the runway (how long until the business runs out of money)?

As you can see, the question “how do you make money?” is a more complex question than it appears on the surface. Hopefully this week’s articles have given you a good sense for how to manage your business to make sure that you can answer the question with confidence for today and the future.